Our flagship course designed to help you improve your ability to interpret and capitalize on global events, business cycles, monetary policy and financial crises by mastering three key areas:

Trading Core Pro® : Trading requires decision-making under uncertainty. To increase your chances of success and minimize risk, you need a framework covering both practical trading experience and relevant theory. Trading Core Pro™ is the outcome of 20+ years of successful trading experience along with 10+ years of training students on a postgraduate university program for future positions in trading/investment management.

CoreMacro®: gain a solid understanding of the investment environment, portfolio theory limitations and the hedge fund indusry. Study interest rate dynamics that drive financial markets, understand technology cycles and the relevance of national innovation systems. Finally, incorporate macro and geopolitical insights to improve your trading/investment results.

Financial Crisis Theory and Case Studies: we extend your knowledge on how to view financial crises from a socio-political point of view. This is expecially relevant during times of financial crises. Our academic research and extensive trading experience are incorporated throughout to provide you with additional insights from The Socio-Political Theory of Crises (SPTC)©.

Online: $1745

24 hour availability | Lifetime access

Enroll below using your desired payment method: Credit Card (Stripe), Paypal, Google Pay or Apple Pay.

Course Information | Highlights

Teacher Background

- 15+ years University Teaching

- 20+ years Trading Experience

- Deep Knowledge of Geo-Politics

- Outstanding Crisis Trading Results

- Developed Financial Crisis Theory

Course Highlights

- Unique Insights – Trading

- Practical Applications

- Combining Theory | Practice

- In-depth Crisis Explanations

- Numerous Resources

Audience Level | Links

- Motivated Traders | Investors

- Asset & Wealth Managers

- Mutual Funds | Hedge Funds

- Book Link: SPTC Theory (Amazon)

- Research Link: Macro Institute

Trading Core Pro®

CoreMacro®

Trading Core Pro® Part I

- Traders and Markets

- Psychological Explanations

- Social Explanations

- Fundamental Explanations

- Trading Frameworks

- Trader Theories

Trading Core Pro® Part II

- Rumors in Financial Markets

- Trading Metrics | Analysis

- Optimal Trading Vehicles

- Trading and Uncertainty

- Trade Risk Management

- Risk Managment Cases

Investments, Interest Rates, Tech Cycles

- Investment Analysis

- Portfolio Theory & Hedge Funds

- Hedge Fund Trading Strategies

- Bond Pricing | Trading Insights

- Sensitivity to Interest Rate

- Tech Cycles & Innovation Systems

Global Macro Strategy

- Monetary Policy | Transparency

- Discretionary vs Systematic

- Macro | Opportunistic

- Speculation | Hedging

- Geopolitical Analysis

- Macro Risk Framework

Financial Crisis Theory and Case Studies

Intro to Financial Crises

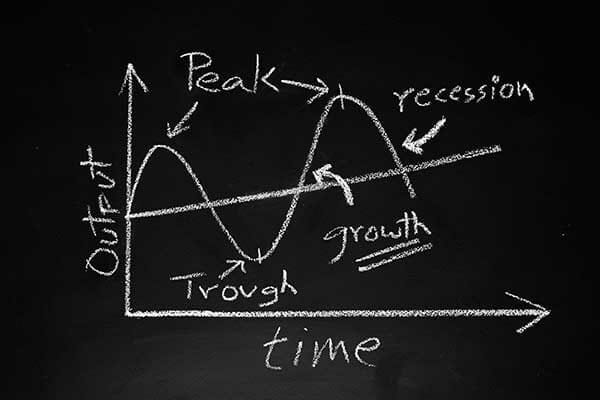

- Business Cycle Theories

- Embedded Assumptions

- Crisis Comparability

- Crisis Predictability

- Trading Crises

Financial Crises Theory

- SPTC Theory©

- The 4-Step Crisis Model

- Financial Agent Model

- Behavioral Factors

- Political Factors

Crisis Case Studies

- 2007-2008 Financial Crisis

- 1997 Asian Financial Crisis

- 1995 Mexican Financial Crisis

- LTCM & Quant Crisis 2007

- Crisis Framework Application